Mission Statement

Our client, a FinTech company, has to deal with complex financial data that demanded a highly accurate and efficient reconciliation processes. Their existing system struggled with inefficiencies and potential inaccuracies, creating risk.

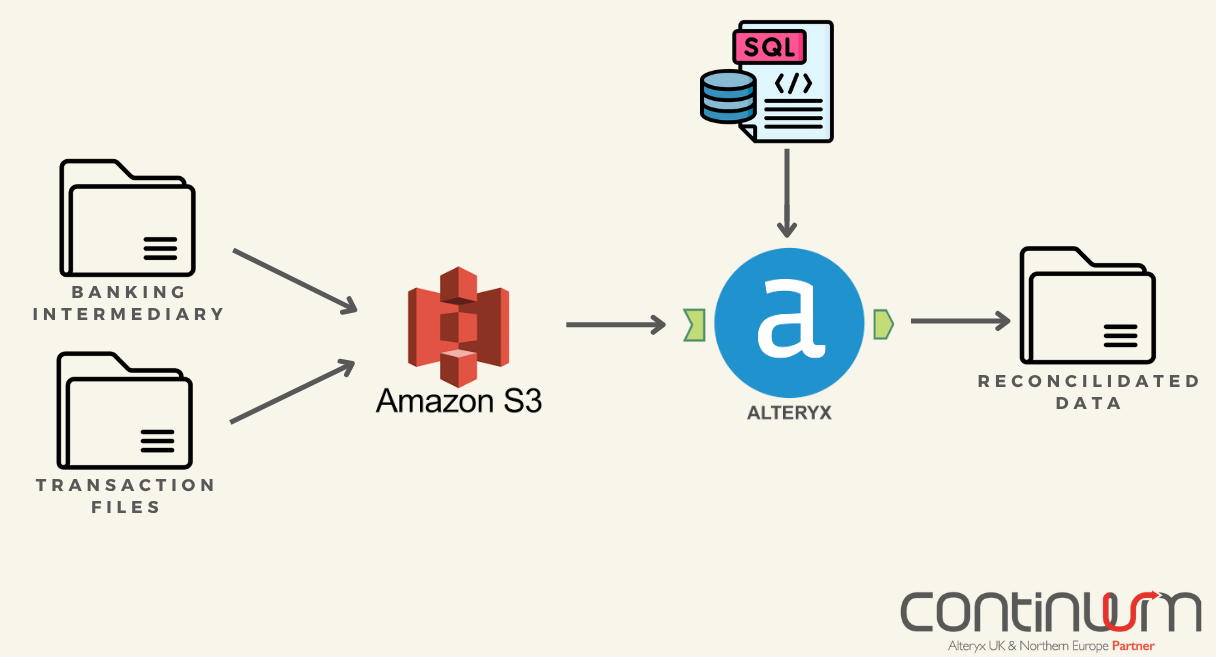

The reconciliation process involved multiple data sources, including transaction files from both the company and a banking intermediary, and required seamless integration with Amazon S3 for secure data storage.

We designed and implemented a robust, automated reconciliation solution capable of handling high volumes of transaction data from multiple sources. This system not only ensured data accuracy but also streamlined financial operations by reducing manual intervention and significantly improving processing speed.

Tools Used

· Alteryx - data blending and analytics to automate and streamline the reconciliation workflow

· Amazon S3 - storing transaction files

· SQL - optimising queries and ensuring efficient data processing

Detailed Solutions

Data Preparation and Integration-

Alteryx workflows were developed to clean, transform, and prepare transaction data. These workflows integrated seamlessly with Amazon S3 to extract and process files from multiple sources. Enhancements such as date filters and comprehensive workflow documentation ensured repeatability and transparency.

Automation and Testing-

Reconciliation activities were automated to minimise manual intervention and speed up processing. The solution underwent multiple testing cycles to validate accuracy and performance before being deployed to production environments.

Handover and Self-Sufficiency-

The workflows and processes were documented and handed over to the organisation’s internal teams, enabling them to manage and scale the reconciliation process independently.

Impact

· Improved Accuracy – Automation reduced the risk of human error and improved data reliability

· Increased Efficiency – Integration of multiple data sources and automation shortened reconciliation cycles

· Scalability – The solution was designed to handle growing transaction volumes as the business expanded

· Compliance and Reporting – Accurate reconciliation supported regulatory compliance and enhanced financial reporting quality