Mission Statement

A global investment advisory firm set out to automate and improve the efficiency of their data processing tasks, particularly around financial reconciliation and expense allocation. They would receive trade confirmations from their custodians as well as internal trade notes, and the task was to reconcile that movement and then the subsequent positions. Previously, these processes were manual, time consuming, and prone to human error, delaying financial reporting and decision making. The organisation needed a solution to streamline these processes, reduce errors, and improve efficiency.

Tools Used

· Alteryx

· Excel

· Bloomberg

Detailed Solution

Automated Expense Allocation:

Previously, clerical staff manually split costs across departments and systems. By building rule-based workflows in Alteryx, expense data is now processed and allocated automatically, dramatically reducing time and errors.

Secure Data Exchange:

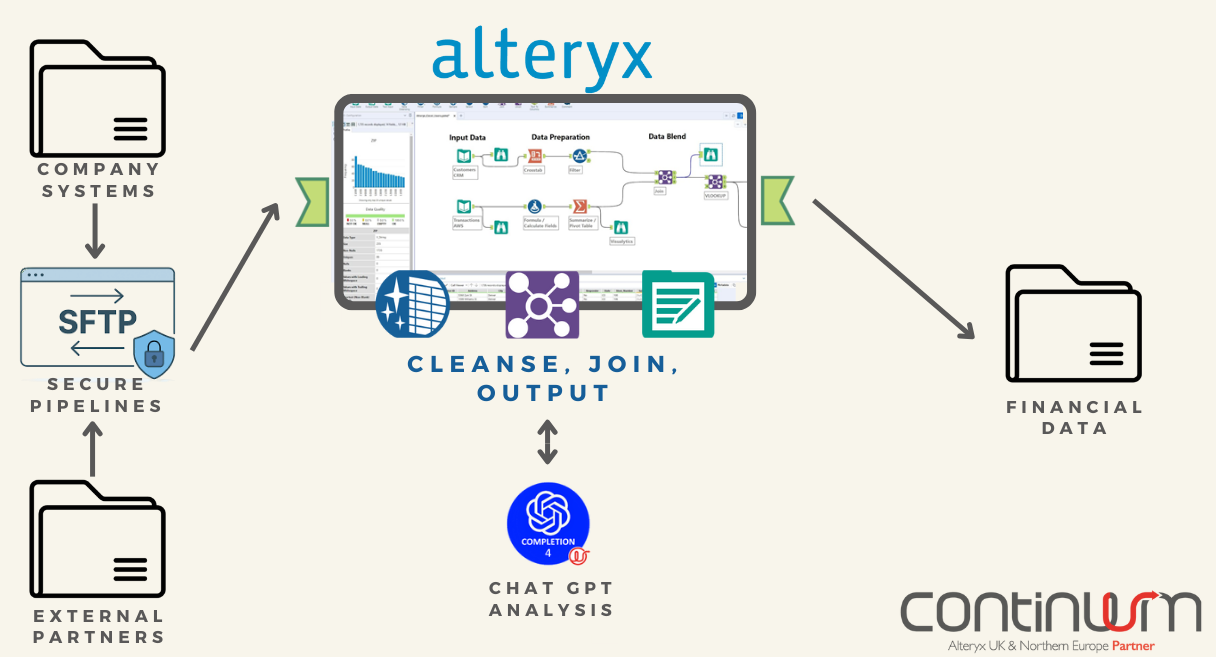

The team implemented SFTP push workflows in Alteryx, creating a secure, automated pipeline for sending and receiving transaction files with external partners. Sensitive financial data now moves between systems safely and reliably, eliminating manual uploads.

Parsing Unstructured Data:

Using ChatGPT connectors within Alteryx, the firm explored automatically extracting and structuring information from unstructured sources such as trade notes. This opened up new insights that were previously locked in free-form communications.

Together, these initiatives transformed a patchwork of manual processes into a streamlined, automated.

Impact

· Efficiency Gains: Automation reduces the time and effort required which allows staff to focus on higher-value activities.

· Accuracy and Reliability: Automation minimises human errors, leading to more accurate financial records and reporting.

· Scalability: The solution can handle increasing volumes of data without a proportional increase in resource requirements.

· Timely Insights: Faster processing times aids quicker decision making.